Closing costs are the various fees, charges, and taxes needed to (A) originate a mortgage loan and (B) transfer property from seller to buyer. Most of these fees are paid by the borrower. In some cases, the seller may contribute money toward the buyer’s closing costs. This can all be negotiated during the offer process.

You’ll Probably Pay More Than This Average

If you do a Google search for closing cost averages for California, you’ll find some numbers in the $4,000—$5,000 range. But when you get an actual estimate from your lender, you may find that your closing costs to be twice this amount. Why? Because most of these “averages” only account for the lender’s fees. They usually leave out the third-party / non-lender fees for a title company, escrow company, etc. And these fees can significantly increase the total amount you pay at closing.

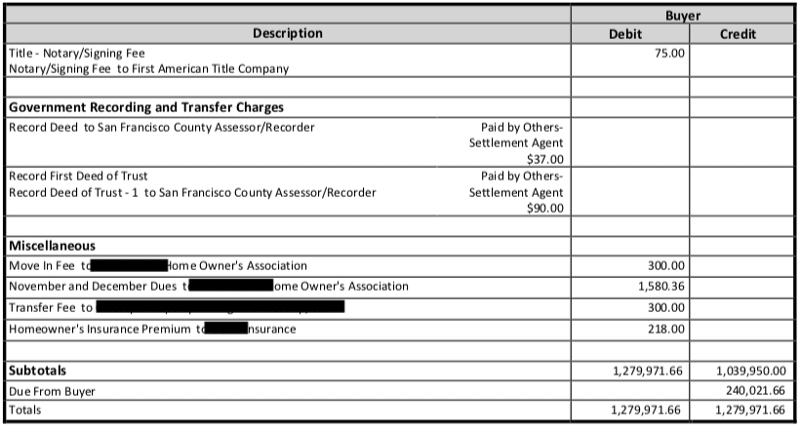

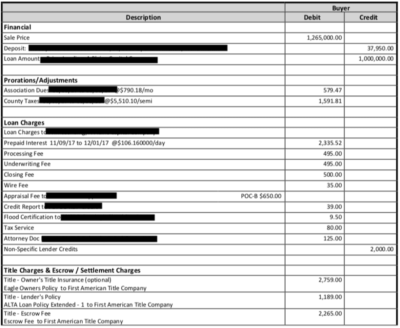

The Actual Categories Of Charges

For most sales in California, the following list of fees and costs are going to be included in closing costs and paid by either the buyer or the seller. Again, some of the fees are negotiable and some are traditionally carried by the buyer or the seller unless the market is extremely favoring one side. For example, when the market is really tight and lacking customers, both lenders and sellers will “eat” many of the closing costs to make a sale happen versus losing a buyer. On the other hand, if a seller’s market then the buyer will be stuck with almost all the costs.

The Actual Categories Of Charges

Expect Surprises And Save Accordingly

My advice is to save extra money for your closing costs. We’ve just seen how they can go up between the time you apply for the loan and the day you close. So expect surprises, and plan accordingly. The more money you can put aside between now and your closing date, the better.

Disclaimer: This article discusses the average closing costs in California, based on a mortgage amount of $500,000. Your actual costs will vary based on several factors. These factors include the size of your loan, the lender you use, and whether or not you choose to pay points at closing. This information is provided as a general guide only. It is not intended to serve as a financial-planning tool.